The smaller of the two numbers is $500.) Now reduce the total by any tax withholdings and tax credits you may have. This year you estimate you will pay $1,000, and 90 percent of that is $900. (For example, you paid $500 as tax the previous year. Compare the two, and take the smaller number. Calculate 90 percent of your total tax you estimate you will owe in the current year. Take your total tax for the previous year. To figure out if you should file 1040-ES for the current year make the following calculation: The Form 1040-ES package includes worksheets to help you account for differences between the previous and current year’s income and calculate the tax you owe. Look at the taxable income, tax paid, credits and deductions from the previous year and compare to the current year’s numbers. To help with the estimation, you can start with the previous year's federal tax return. The calculation is based on an estimate of current income. You should also pay the quarterly tax in a timely fashion, or you may find yourself subject to a penalty for a particular quarter because the tax was received late, even if you overpaid the total tax due for the year and are eligible for a refund. You need to pay a sufficient amount when you make your payments. The requirement for making estimated taxes has both timeliness and amount elements. If you end up overpaying, you can receive a tax refund at the end of the year or carryover the excess amount to help pay the estimated taxes for the next year. In many cases, as long as you pay 100 percent of the previous year's tax, you won’t be subject to the penalty. To avoid this penalty, you can use your previous year’s taxes as a guide. As such, it is possible to underestimate, resulting in an underpayment and penalty. The estimated tax payment is based on an estimation of your income for the current year. If you have any of theses types of income coming in, then you might need to pay estimated taxes during the year. Earnings from interest, dividends and rent, taxable unemployment compensation, retirement benefits and the taxable part of your Social Security benefits are other examples of income that often does not have tax withheld at the source. Independent contractors and freelancers, for example, typically do not have tax deducted from their pay. And once the IRS has accepted your tax return, you’ll be the first to know through push notifications.Not all taxable income is set up so that taxes are deducted at the source. The app automatically saves your info as you go, so you can switch devices and never miss a beat. The app can use past tax returns to save you time, and you can simply take a picture of your W-2 of 1099-NEC to enter it into the system. TurboTax Appĭownload the TurboTax app to file your taxes anytime, anywhere. Referrals are good for up to 10 people, giving you the potential gift card earnings of up to $250. Share your love of TurboTax by sending referral links to your friends! When your friends file online for the first time using your link, they’ll get 20% off at TurboTax and you’ll get a $25 gift card.

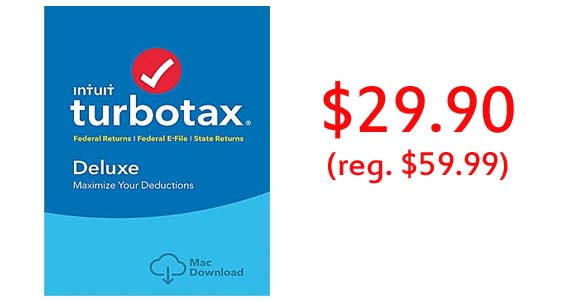

TurboTax Invite-a-Friend Referral Program The sales tend to cool down the closer you get to the tax deadline, but you can still save with TurboTax discounts from Groupon Coupons. Be sure to check the site as soon as you receive your tax documents to take advantage of these limited-time offers. TurboTax releases their best offers, like 25% off filing your federal taxes online, in January and February. And when you e-file with Turbotax, you’ll get the fastest refund possible. This especially comes in handy when navigating life changes like marriage, kids, and homeownership TurboTax ensures you’re getting the most up-to-date information on deductions and tax credits.

Whether you want to file your taxes yourself or leave it to the tax pros, TurboTax’s online tools will get you your maximum refund-guaranteed.

PRINTABLE TURBOTAX COUPON CODE

Here, you’ll need to sign in or make an account. If there’s a coupon to use, copy the service code and follow the link through to the Turbotax site.If it’s an offer without a code, follow the link through to the website-your discount will be applied automatically.Select the Turbotax offer you want to redeem.

0 kommentar(er)

0 kommentar(er)